Over the years I have come to find the majority of investors tend to still think that buying a flip property in a company is better than buying it their own name regardless if they own one or more properties in their name.

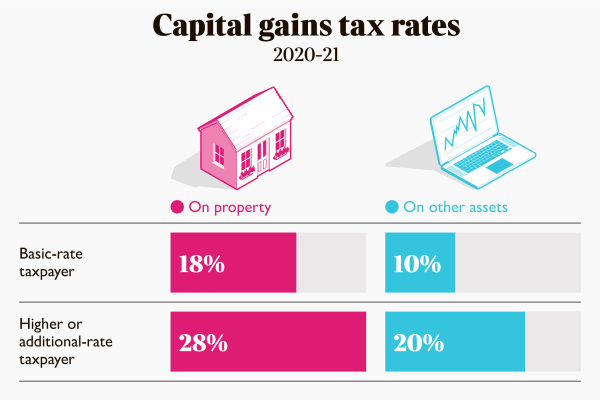

Most investors are lead to believe that’s it’s simple, capital gains TAX is 28% and corporation TAX is 19% so they think obviously buying it in a company is more tax efficient as 19% is better than 28%, this is true in most cases if you were going to hold on to the property for a rental however for a flip this isn’t the most tax-efficient way.

What most investors don’t know is that capital gains TAX provides more loopholes in the property TAX system.

Before you continue to read I would like to emphasize that I am not a TAX adviser and you should speak to your TAX adviser or get in contact with us and we can provide you with access to our team.

So let’s get into it,

There is a £12,300 TAX relief per financial year (April 5 -April 6) for capital gains TAX for every individual on profit for property meaning you won’t be taxed on any profit you make in property up to the first £12,300 and anything above that figure depending on where you sit in the income tax scale if under 40% and additional 18% will be taxed on anything above £12,300 and if you are above the income ta scale of 40% you are subject to pay 28% ta on anything above £12,300.

A common miss conseption is that you cannot add your expenses under capital gains tax for property and it’s calculated like other assets like a painting being bought for £6,000 and being sold for £26,000 meaning you will pay 28% on the difference on the £20,000. With property you can add all your expenses in purchase and sale snd you can add expenses of the refurbishment which you spent on adding the value. ( do speak to your ta advisor or give us an all)

07909613771 [email protected]

Ready to find out more?

We will find you the Invesment deals!