Newcastle avenue is one of my favourite property investment Deals. The property is in the heart of a town called Worksop. This property was a strange property as most would be shied away from it. I found this property on the Hot open market with an agent I hadn’t dealt with before but knew I had a potential investment opportunity for our investor, I know the property done to a good standard could sell for £130,000 – £143,000 but the property did not have any photos on the listing so we booked a viewing.

This property was on the market for offers around £75,000 and was a strange property due to the fact that it was purchased in April 2020 for £55,000 and was now listed on the open market in March 2021 for £75,000 which is strange and hard to figure out due to the fact that the property still wasn’t in a refurbished state but this comes to show it is not about what the property is listed for but how much it is worth to you.

Throughout my du diligence, I came across the property 2 to the left of this property that was an identical layout property and was made into 4 apartments by splitting the title deads from a freehold into multiple leaseholds

This is great as it’s different from an HMO (house with multiple occupancies) as it doesn’t require an HMO council licensing and doesn’t require a strict regulation guideline which costs a lot of money and has its own challenges when it comes to running it as a rental investment.

I spoke to the agency that had the apartments listed and it was an agency we had a good relationship with, they told us that the apartments had great demand and were all rented very quickly and with a lot of demand. I got full videos of the identical property 64 (we got 60) and even had a chat with the owner of the property at a later date and got the connection of the build team that did the job for number 64.

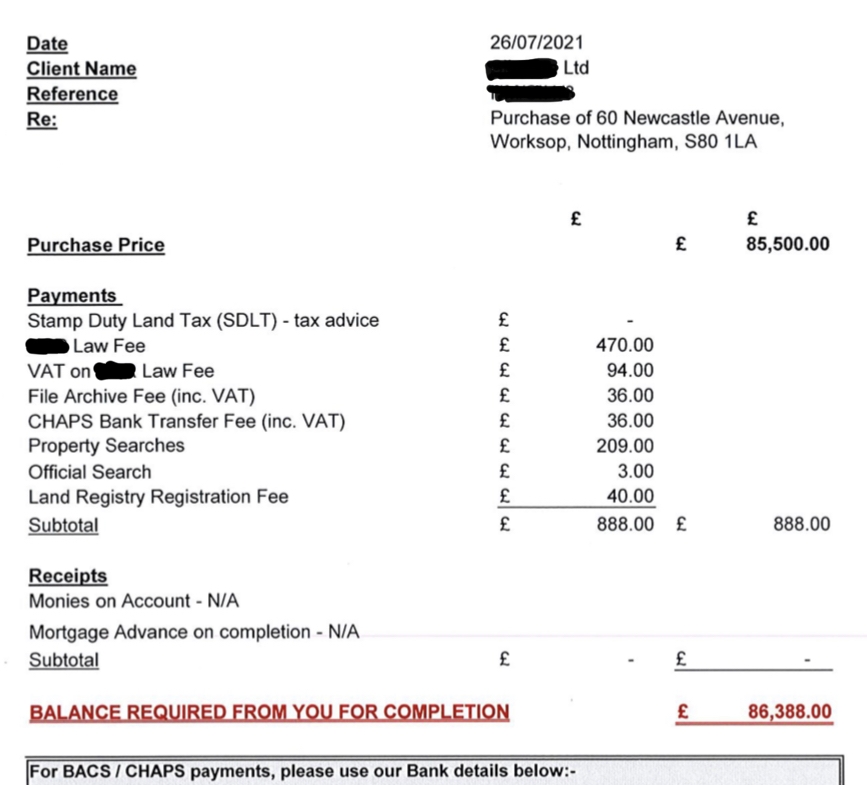

With these exits in mind, we negotiated the property with a purchase price of £85,500.00 which is still way over the asking price however there was a lot of competition with multiple parties but with our expertise, we managed to wrap up the property and turn it into STC on the same day of the viewing which was only 3 days after the property had come on the open market.

The property had been bought earlier in the year and in the viewing, we found out the owner had started building works in the property and was what seemed to be 1/3 along the way of Refurbishment which was funny to see as other builders and investors seem to be doing a terrible job on the refurbs, an example of why I say this is that they were putting a wall over the chimney to easily remove the chimney which is terrible to do as it makes the room so much smaller, just remove the chimney for an extra £200.

We also didn’t pay any stamp duty on this property as it wasn’t in a habitable state. ARM Empire can connect you with the right tax advisers to Save you thousands on SDLT. We saved our client £2,565.00

I would like to add that this property had minor issues that came across in the searches and we had to speak to multiple insurance companies and mortgage companies for our exit strategies as there were factors like flooding risk and it was next to a fish and chips shop that if you don’t speak to the right people and don’t know what you are doing you should stay well away from these. ARM Empires team are experienced and has the expertise to take care of your investment.

PURCHASE Price £85,500

Stamp duty = £0 We didn’t pay it as we were exempt through a legal loophole.

Solicitor / Legal costs £888.00]

£86,388.00 full cost

ARM Empire Fee (£2,000) but we were under a bespoke agreement on this one.

£88,388.00 full cash invested to receive the keys.

Refurb and sale Cost if done up to residential = £27,500 If done into 4 -5 self-contained FLATS including fees £48,000

Total cash £115,888 (done to a residential)- £134,388 (done as 5 Flats)

end value £130,000 (done to a residential) – £240,000 (done to 5 flats)

Profit £14,112 – £71,612 – £95,612 (CONVERTED TO fLATS)

Before Every deal completes I always do a market update call to ensure the deal stacks up and our investor is safe and I try to get accurate figures before we exchange contracts and if the deal is no longer worthwhile we make sure to not continue and cover all costs with a refund or we do recalculations to ensure the investor is up to date and taken care of.

Find below a video of me doing the last calls to agents trying to get the absolute safest figures at the very end before we exchange contacts.

ARM Empire Part 1

We didn’t overestimate and wanted to receive accurate figures. Take a look

Flats are going for sale at this moment in time for 50-60k per flat and the end value with 4 flats comes to 190k 5 flats £230k

ARM Empire Part 2

Down Below please find attached the completion statement and photos of the property and a video tour of the property 2 to the right (depending on how you look at it) which was converted into 4 self-contained flats.

The one we sourced was bigger in size and could be turned into 5 flats

Ready to find out more?

We will find you the Invesment deals!