Lindsey road was a property we soured from a local agent that was introduced originally with a sitting tenant,

We did our calculations and knew it was a potential deal so we went along for a viewing. It was originally going on the open market for £80,000 and we had offered £75,000 which was then negotiated to 77k however we still hadn’t viewed the property, after coming for the viewing we had issues getting in as the tenant didn’t want to show us around the property and wasn’t home to let us in. After a few heated phone calls, we managed to get them to get the tenant to come and let us in. My gosh was the property a dump! I don’t know how the tenant was living in there with the smell and rubbish and used car parts everywhere, mountains of trash! The property looked nothing like the images that were sent to me beforehand and we quickly left the property holding our breaths.

I waited and the next day at the office I got a call from an agent which I explained the situation and decided to drop my offer down to 68k, we managed to negotiate to £71,000 subject to the property being cleared from all rubish and the tenant to vacate the property which was accepted. This was great as I knew properties in a refurbished condition would sell for £96,000 – £106,000 Which would leave a nice chunk of profit for my Investor! As the market continued to boom we had new end valuation estimates of £109,000- £117,000 so we decided to increase our refurb quality.

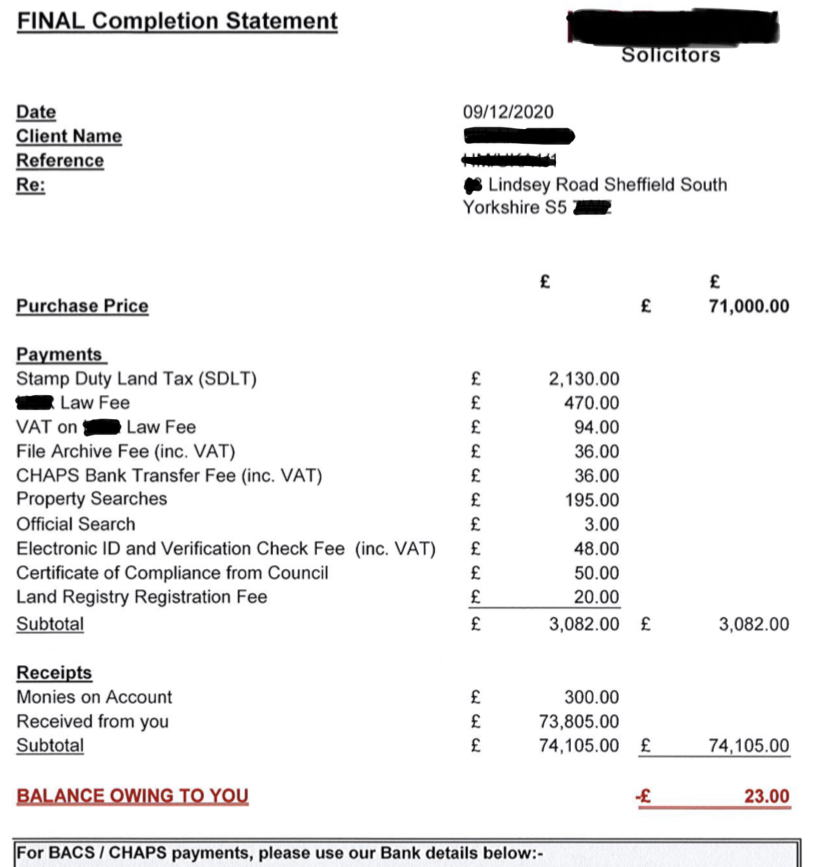

The total purchase came to a Total of £74,082.00

purchase price = £71,000.00

Stamp Duty Land Tax (SDLT) =2,130.00

Solicitor / legal costs = £952.00

ARM Empire fee £2,500

holding cost £300 (this is money paid for council Tax)

total cost until we started the refurbishment = 76,882.00

Refurb cost including labor and materials = £14,700

Total cash invested £92,582.00

End sale £116,250

This made a flip profit of £23,668.00 which is a 25% ROI Return on cash invested in 7 months!

ARM Empire Compleation Statement

ARM empire Front Before

ARM Empire Front Refurb

ARM Empire Lounge Before

ARM Empire Kithen Before

ARM Empire Lounge/ Kitchen open plan Refurb

ARM Empire Kithen Refurb

ARM Empire Downstairs Refurb

ARM Empire Garden Refurb

ARM Empire rear before

ARM Empire rear Refurb New waste pipes and plumming

Ready to find out more?

We will find you the Invesment deals!