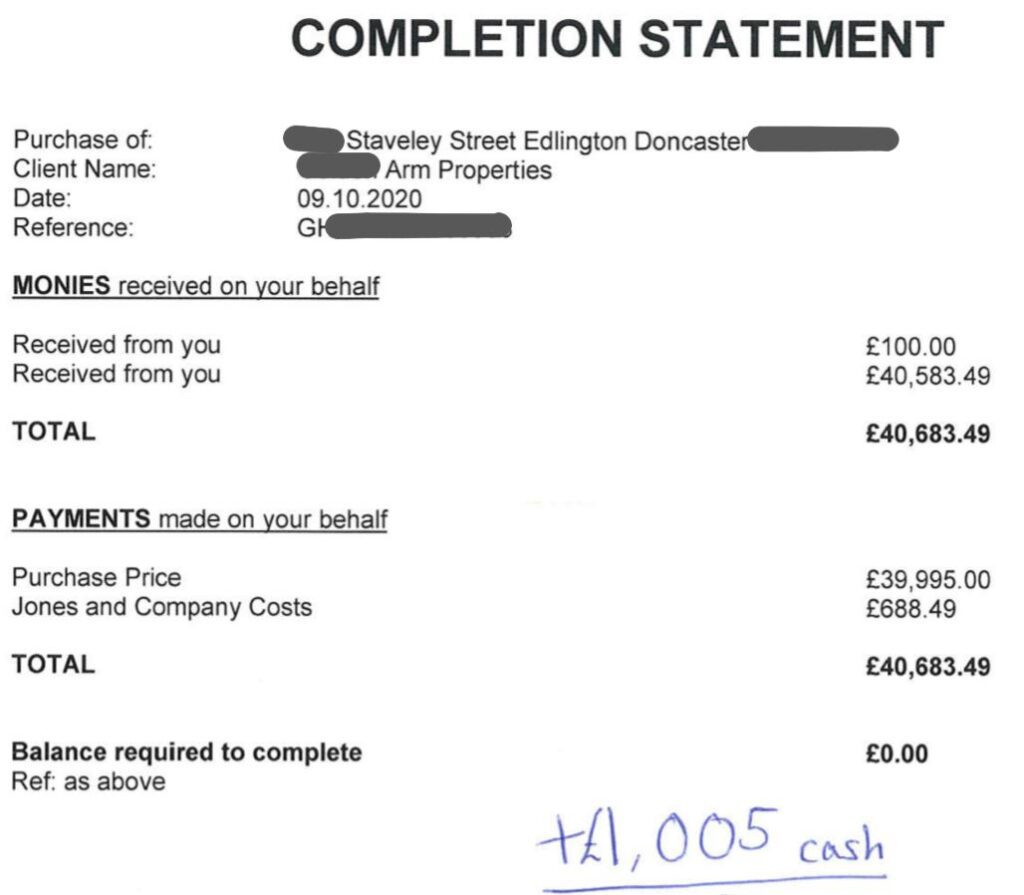

We sourced this property for a client of ours making him a return of 24% cash flip in about 8 months. I negotiated this property through an agent I knew well and have bought many properties through. It was on the market for offers of over £45,000 We had done our research on the area and knew well that this property was exactly the small flip our investor was looking for. After the viewing, I managed to negotiate the property cash for £41,000. This figure is above the limit to avoid stamp duty, so I had the property bought on paper for £39,995 and the further £1,005 was given directly to the seller, therefore, avoiding the stamp duty and saving our client £1,230. The full purchase price including our legal fees with our solicitors. To get the keys to our hands it came to £41,683. Upon initial research, we had estimated a full refurbishment price of £15,000 and an end sale of £69,000 -£72,000 – £75,000.

We ended up changing a few things along the way as the investor was getting some material ready for the refurb at his own choosing (can be done by ARM Empire if you wish). The final figures were £25,000 for the refurb which is higher than originally estimated as we ended up doing a complete back to brick start and a higher level refurb and sorting out an unseen issue under the flooring bringing the total cash invested to £66,683.49. We were monitoring the properties’ valuation frequently and had calculated and agreed to the increase of the refurb ahead of time due to the fact that the area had a small calculated short-term capital gain meaning we were now estimating an increase in the sale price of £75,000 – £85,000 so an increase in the refurb and finish of the property would-be worthwhile. Once done we put it on the market for offers over £82,500 we received multiple formal offers. Two offers at 85,000 one buyer with a 10% deposit and another with a 15% deposit and received another at £82,00, we decided to reject these offers as they may have caused an issue in the long run if their mortgage company downvalued at £80,000 meaning they could be out of pocket to pay the remaining £5,000. It is now sold STC for £83,000 with a strong position 25% BTL mortgage buyer. We had many offers for this property and decided to go with the safest buyer with the highest mortgage in case the lender values the property at 75k-80k.

This property made a profit of £16,017 after all costs.

Now that’s what I call business.

It has gotten very tough to come across these types of property deals in the market of 2021 so what we recommend to our investors is to keep the deals and not sell them on unless they make a higher return on a flip. The reason being is that they can actually pull out most of their money with a buy-to-let interest-only mortgage and create generational wealth and basically end up with a free property generating cash flow.

I am always happy to help so give me a call on 07909613771 or drop an email to [email protected] where one of the team will respond.

ARM EMPIRE

We project manage the refurb process

ARM Empire

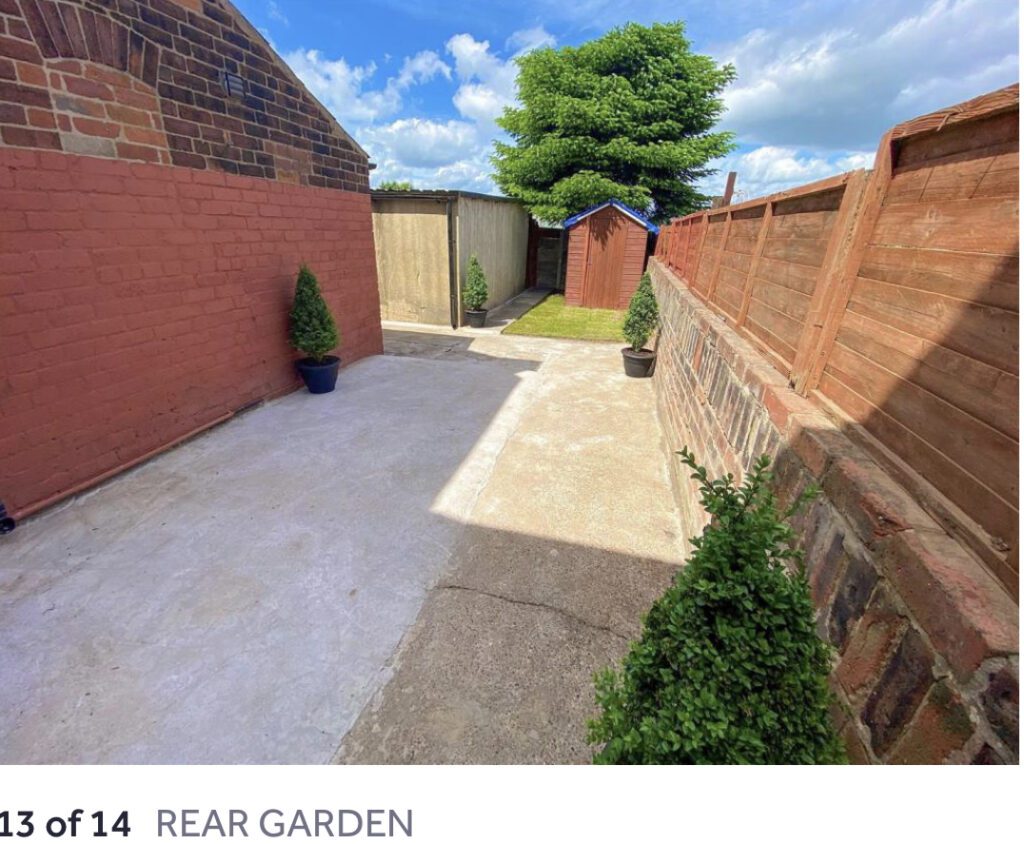

The final snags of the refurbishment Ground floor

Have Any Questions? Give me a call on 07909613771 or drop us an email on [email protected]

OUR FEE for this project is £2,200 We also provide a full management fee for an additional £2,000 if you want ARM Empire to manage the entire process.

If you have CASH ready to invest with experts get in contact today

Ready to find out more?

We will find you the Invesment deals!